|

|

|

www.design-reuse-china.com

www.design-reuse-china.com |

|

Value of Semiconductor Industry M&A Deals Slows Dramatically in 1H17

Numerous smaller deals have been made but "megadeals" have yet to surface this year.

Jul. 25, 2017 – In its upcoming Mid-Year Update to The McClean Report 2017 (to be released later this week), IC Insights addresses the changing landscape for semiconductor industry mergers and acquisitions.

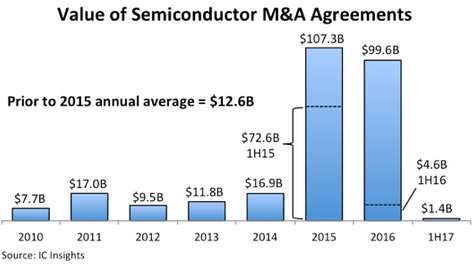

The historic flood of merger and acquisition agreements that swept through the semiconductor industry in the past two years slowed to a trickle in the first half of 2017, with the combined value of about a dozen transactions announced in 1H17 reaching just $1.4 billion.

In the first halves of 2016 and the record-high M&A year of 2015, the combined value of acquisition agreements in 1H16 and 1H15 totaled $4.6 billion and $72.6 billion, respectively (Figure 1). Last year, M&A got off to a slow start-compared to the record-breaking pace in 1H15-but several large transactions announced in 3Q16 pushed the 2016 total value in semiconductor acquisitions to nearly $100 billion and within striking distance of the all-time high of $107.3 billion set in 2015. A few major semiconductor acquisitions were pending or rumored to be in the works during July 2017, but it is unlikely that a 2H17 surge in purchase agreements will bring this year's M&A total value anywhere close to those of 2016 and 2015.

The big difference between semiconductor M&A activity in 2017 and the prior two years has been the lack of megadeals. Thus far, only one transaction in 2017 has topped a half billion dollars (MaxLinear's $687 million cash acquisition of analog and mixed-signal IC supplier Exar announced in March 2017 and completed in May). There were seven announced acquisitions with values of more than $1 billion in 2016 (three of which were over $10 billion) and 10 in 2015 (four of which were over $10 billion). IC Insights' M&A list only covers semiconductor suppliers and excludes acquisitions of software and systems businesses by IC companies (e.g., Intel's planned $15.3 billion purchase of Mobileye, an Israeli-based provider of digital imaging technology for autonomous vehicles, announced in March 2017).

The 250+ page Mid-Year Update to the 2017 edition of The McClean Report further describes IC Insights' updated forecasts for the 2017-2021 timeperiod.

Figure 1

Report Details: The 2017 McClean Report

Additional details on the IC market forecast and trends within the IC industry are provided in The McClean Report-A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2017). A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2017 edition of The McClean Report is priced at $4,090 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,090.

Back

Back